In the fast-paced world of Decentralized Finance (DeFi), liquidity is the heartbeat. But for BNB Chain traders, moving through fragmented pools and limited depth can be like navigating rough waters. That’s where THENA comes in—a decentralized exchange on the BNB Chain known for its user-friendly interface and top-notch trading tools.

Today, THENA announced that it’s teaming up with Orbs, a layer-3 platform known for bringing innovation to smart contracts. This collaboration involves integrating Orbs’ game-changing Liquidity Hub, and it’s set to redefine the game for THENA and its community of traders.

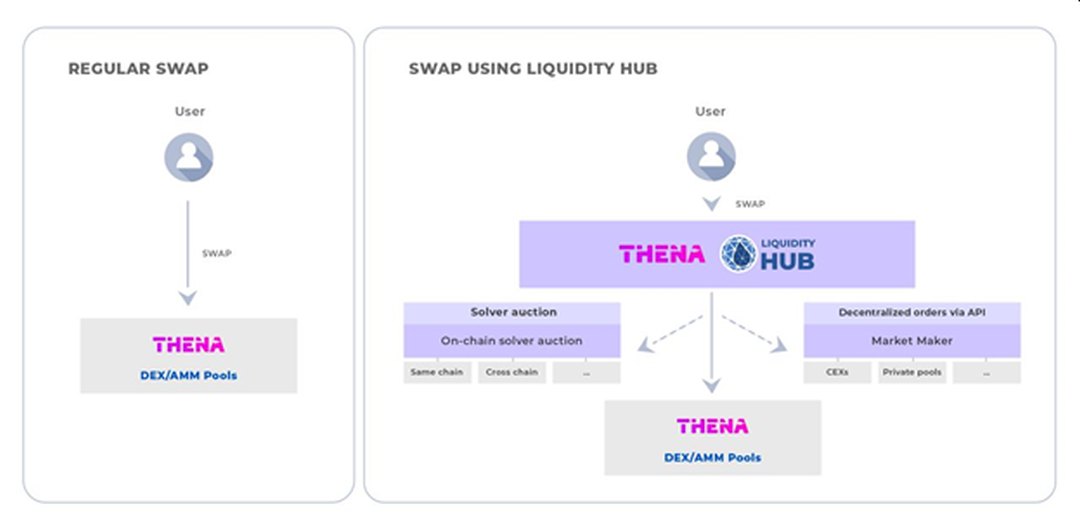

The main challenge in the world of Decentralized Finance (DeFi) is dealing with scattered liquidity across various DEXs. Isolated pools create limitations in options and depth, often resulting in price slippage—a situation where the executed price differs from the intended due to a shortage of assets. Orbs’ Liquidity Hub takes on this challenge by connecting THENA to a vast external network of liquidity reserves. It’s like unlocking access to a hidden treasure trove of assets.

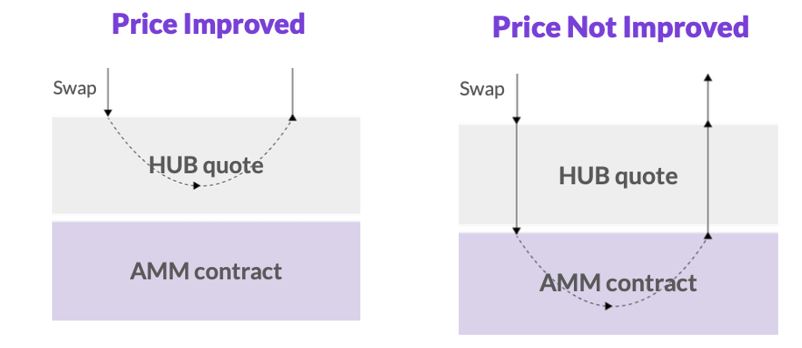

This integration brings significant benefits for THENA’s traders. They will now be able to tap into additional liquidity on the BNB Chain network, which was previously inaccessible through the standard AMM. The Liquidity Hub, powered by Orbs’ L3 technology, brings lower fees, MEV protection, gasless transactions, increased capital efficiency, a simplified user interface, and more. Notably, this integration is only the second of its kind for Liquidity Hub by Orbs and is one of the few in the entire DeFi space that aggregates liquidity from both on-chain and off-chain sources to a DEX.

Liquidity Hub stands out as a fully decentralized, permissionless, and composable DeFi protocol developed by the Orbs project and fueled by the Orbs Network. With this collaboration, THENA’s traders gain access to all the liquidity that the BNB Chain offers, and the best part is that there’s no additional cost.

Orbs, operating as a decentralized protocol with a public network of permissionless validators using PoS, has staked tens of millions of dollars in TVL. The project introduces the concept of L3 infrastructure, leveraging the Orbs decentralized network to enhance the capabilities of existing EVM smart contracts. This opens up a new realm of possibilities for Web 3.0, DeFi, NFTs, and GameFi.

“Orbsis a decentralized protocol executed by a public network of permissionless validators using PoS, staked with tens of millions of dollars in TVL. Orbs pioneers the concept of L3 infrastructure, by utilizing the Orbs decentralized network to enhance the capabilities of existing EVM smart contracts, opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs, and GameFi.”